ETFGI reports net inflows into ETFs and ETPs listed in the US at the end of Q3 are US$299.86 billion significantly more than the US$196.54 billion gathered at the end of Q3 2019

LONDON — October 14, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in US gained net inflows of US$35.54 billion during September, bringing year-to-date net inflows through the end of Q3 to US$299.86 billion which is significantly more than the US$196.54 billion net inflows gathered at the end of Q3 2019. Assets invested in the US ETFs/ETPs industry have decreased by 2.5%, from US$4.85 trillion at the end of August, to US$4.73 trillion, according to ETFGI's September 2020 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

• During September 2020, ETFs and ETPs listed in US attracted $35.54 billion in net inflows with Equity products being the most attractive among all asset classes.

• Year-to-date through end of Q3 net inflows of $299.86 billion are much higher than the $196.54 billion gathered at the end of Q3 2019.

• Assets of $4.73 trillion invested in ETFs and ETPs listed in US at the end of September are the 2nd highest on record.

“The S&P 500 declined 3.8% in September, with concerns over back-to-school (and resulting COVID cases), U.S. elections and stimulus talks. Strong prior month gains boosted the index higher to close up 8.9% for Q3. Global equities declined 3.1% in September, as measured by the S&P Global BMI. Despite the monthly decline, the global benchmark managed to finish Q3 up 8.1% Q3 and up 0.7% YTD. Emerging markets, declined 2.2% in September but closed up 9.0% for Q3.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in US ETF and ETP assets as of the end of September 2020

The US ETF/ETP industry had 2,371 ETFs and ETPs, assets of $4.73 trillion, from 165 providers listed on 3 exchanges at the end of Q3 2020.

During September 2020, ETFs/ETPs gathered net inflows of $35.54 billion. Equity ETFs/ETPs listed in US reported net inflows of $18.09 billion over September, bringing YTD net inflows for 2020 to $76.36 billion, more than the $74.85 billion in net inflows Equity products had attracted for the corresponding period to Q3 2019. Fixed income ETFs/ETPs listed in US reported net inflows of $10.11 billion over September, bringing YTD net inflows for 2020 to $130.39 billion, more than the $96.34 billion in net inflows Fixed income products had attracted for the corresponding period to Q3 2019. Commodity ETFs/ETPs gathered $1.43 billion in September bring YTD inflows to $44.56 billion which is significantly more than he $9.43 billion gathered in Q3 2019. Active ETFs/ETPs gathered net inflows of $5.45 billion, bringing the YTD net inflows to $36.14 billion for 2020, which is higher than the $17.02 billion in net inflows for the corresponding period to September 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $32.72 billion during September. The iShares Core S&P 500 ETF (IVV US) gathered 3.89 billion alone.

Top 20 ETFs by net new assets September 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Core S&P 500 ETF |

IVV US |

211,987.51 |

7,259.01 |

3,894.75 |

|

Invesco QQQ Trust |

QQQ US |

135,714.21 |

18,431.77 |

3,769.45 |

|

Vanguard Total Stock Market ETF |

VTI US |

161,857.54 |

17,941.48 |

3,752.93 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

26,218.79 |

8,458.48 |

2,291.43 |

|

Vanguard Total Bond Market ETF |

BND US |

62,278.25 |

11,223.25 |

1,962.22 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

80,896.61 |

8,086.85 |

1,938.47 |

|

Vanguard Total International Bond ETF |

BNDX US |

32,425.99 |

7,151.14 |

1,834.18 |

|

ProShares UltraPro QQQ |

TQQQ US |

8,775.46 |

937.60 |

1,684.25 |

|

Vanguard S&P 500 ETF |

VOO US |

160,023.80 |

17,934.37 |

1,610.89 |

|

KraneShares CSI China Internet ETF |

KWEB US |

2,832.83 |

2,195.00 |

1,167.10 |

|

SPDR S&P 500 ETF Trust |

SPY US |

293,891.30 |

(29,615.04) |

1,118.81 |

|

Vanguard Short-Term Corporate Bond ETF |

VCSH US |

32,706.31 |

6,207.37 |

1,053.62 |

|

Vanguard Value ETF |

VTV US |

51,050.59 |

2,411.52 |

1,022.27 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

19,094.45 |

(1,633.48) |

1,018.97 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

71,276.18 |

3,426.50 |

942.31 |

|

Industrial Select Sector SPDR Fund |

XLI US |

12,179.73 |

2,521.19 |

830.48 |

|

Vanguard Intermediate-Term Bond ETF |

BIV US |

14,905.76 |

512.75 |

757.24 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

14,599.47 |

4,310.91 |

710.83 |

|

Vanguard Dividend Appreciation ETF |

VIG US |

47,268.92 |

3,781.38 |

690.36 |

|

ARK Innovation ETF |

ARKK US |

8,871.34 |

4,208.00 |

674.31 |

The top 10 ETPs by net new assets collectively gathered $2.95 billion during September. The SPDR Gold Shares (GLD US) gathered $1.12 billion alone.

Top 10 ETPs by net new assets September 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

75,827.44 |

21,165.19 |

1,117.39 |

|

iShares Gold Trust |

IAU US |

31,430.00 |

9,073.29 |

809.41 |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

740.61 |

551.85 |

335.96 |

|

MicroSectors FANG+ Index 3X Leveraged ETNs due January 8, 2038 |

FNGU US |

862.55 |

236.21 |

236.21 |

|

SPDR Gold MiniShares Trust |

GLDM US |

3,561.27 |

2,010.65 |

169.39 |

|

ProShares Ultra Silver |

AGQ US |

625.13 |

296.47 |

69.13 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

1,037.02 |

(643.87) |

65.41 |

|

Aberdeen Standard Physical Platinum Shares ETF |

PPLT US |

1,089.77 |

428.02 |

54.88 |

|

Teucrium Soybean Fund |

SOYB US |

128.51 |

92.68 |

47.50 |

|

MicroSectors FANG+ Index -3X Inverse Leveraged ETNs due January 8, 2038 |

FNGD US |

88.23 |

128.54 |

46.87 |

Investors have tended to invest in Equity ETFs/ETPs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

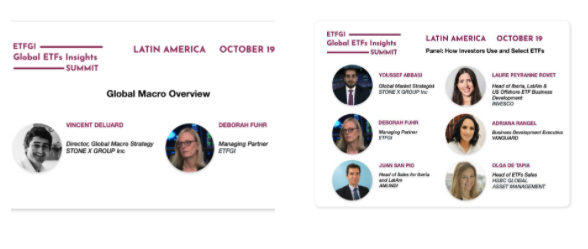

New speakers have been announced for the ETFGI Global ETFs Insights Summit - Latin America, a virtual event taking place on October 19 from 9:00am to 3:00pm EST and receive a free copy of the ETFGI directory of ETFs and ETPs listed in Latin America!

Complimentary registration is available for buyside investors in Latin America, educational credits and free copy of the ETFGI directory of ETFs and ETPs listed in Latin America for all attendees! Register at https://bit.ly/3di8yxz Can't attend on the day? Register anyway, https://bit.ly/3di8yxz and you'll receive recordings of all the sessions.

Visit the event website for the full agenda and speaker details https://bit.ly/34f8Z7A

Topics include: Global Macro outlook, How to use and select ETFs, The new Brazilian depository receipts on foreign ETFs, Pension funds in Chile being able to invest in Gold ETPs, How to trade US listed and European listed UCITS ETFs, Use of ETFs in Brazil, Colombia, Costa Rica, Chile, Peru, Mexico.

Speakers include: ETF Issuers - Invesco, Vanguard, Amundi, HSBC, State Street Global Advisors SPDR ETFs, WisdomTree, BlackRock, and Itaú Asset Management, trading firms - Jane Street, Stone X, Law Firms - Morgan, Lewis & Bockius LLP, Creel, Facio & Cañas, Alessandri, TozziniFreire Advogados, Brigard Urrutia, Exchanges - Bolsa Mexicana de Valores, Bolsa de Valores de Lima, B3, Bolsa de Santiago

FEATURED SESSIONS

Thank you to our sponsors, supporters and speakers.

![]() ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

![]()

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com